Definition: COSO Framework for Internal Controls

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) was established as a voluntary private-sector initiative to enhance organizational performance and governance through adequate internal controls, enterprise risk management, and fraud deterrence. It provides a widely accepted model for evaluating and improving organizations’ controls, essential for the integrity of financial reporting and operational efficiency.

The five founding bodies of COSO were the American Institute of Certified Public Accountants (AICPA), the Institute of Management Accountants (IMA), the American Accounting Association (AAA), the Institute of Internal Auditors (IIA), and the Financial Executives International (FEI)

Historical Context

During the 1970s and 1980s, numerous corporate fraud cases eroded public confidence in corporate financial reporting and exposed serious weaknesses in control mechanisms for accurate financial reporting. The National Commission on Fraudulent Financial Reporting, also known as the Treadway Commission, was established in 1985. After conducting a two-year root analysis, the Commission published its report, identifying weak internal controls as the primary factor in fraudulent reporting. The founding bodies further worked together for five years to develop what would become the landmark 1992 Internal Control – Integrated Framework.

Despite the availability of the COSO framework, the late 1990s and early 2000s witnessed some of the largest corporate fraud scandals in history. Cases like Enron, WorldCom, and Tyco exposed severe deficiencies in corporate governance, accounting practices, and internal controls. The Sarbanes-Oxley Act (SOX) was passed by the U.S. Congress in 2002, which mandates that public companies establish and maintain internal controls over financial reporting and management, and that auditors perform regular assessments of their effectiveness.

In 2013, COSO updated its framework in response to the evolving risks, technologies, and stakeholders’ expectations. This refreshed framework maintained the five components but introduced seventeen principles to articulate the foundational concepts associated with each element.

COSO provides periodic updates and guidance on emerging risks. A recent example is the 2023 Internal Control over Sustainability Reporting (ICSR), which reflects the growing importance of environmental, social, and governance (ESG) reporting in corporate accountability.

Scope and Objectives COSO Framework

The COSO framework establishes internal controls as a comprehensive system designed to provide reasonable assurance in achieving objectives across three categories:

- Operations: Ensuring the efficiency and effectiveness of an entity’s operations, including financial performance goals and safeguarding assets against loss. Controls in this area optimize resource utilization, enhance operations effectiveness, maintain continuity, and protect physical and intellectual assets from damage and misappropriation.

- Reporting: Ensuring reliability, timeliness, and transparency of internal, external financial and non-financial reporting to promote trust in stakeholders and fulfil regulatory compliance requirements.

- Compliance: Focusing on adherence to relevant laws and regulations to help organizations avoid legal sanctions, regulatory penalties, and reputational damage.

COSO Internal Control Framework integrates with COSO Enterprise Risk Management (ERM), which provides a broader view of how organizations should identify, assess, and manage risks that could affect the achievement of their strategic objectives. An internal control framework provides the mechanisms and structures through which many of the identified risks could be mitigated.

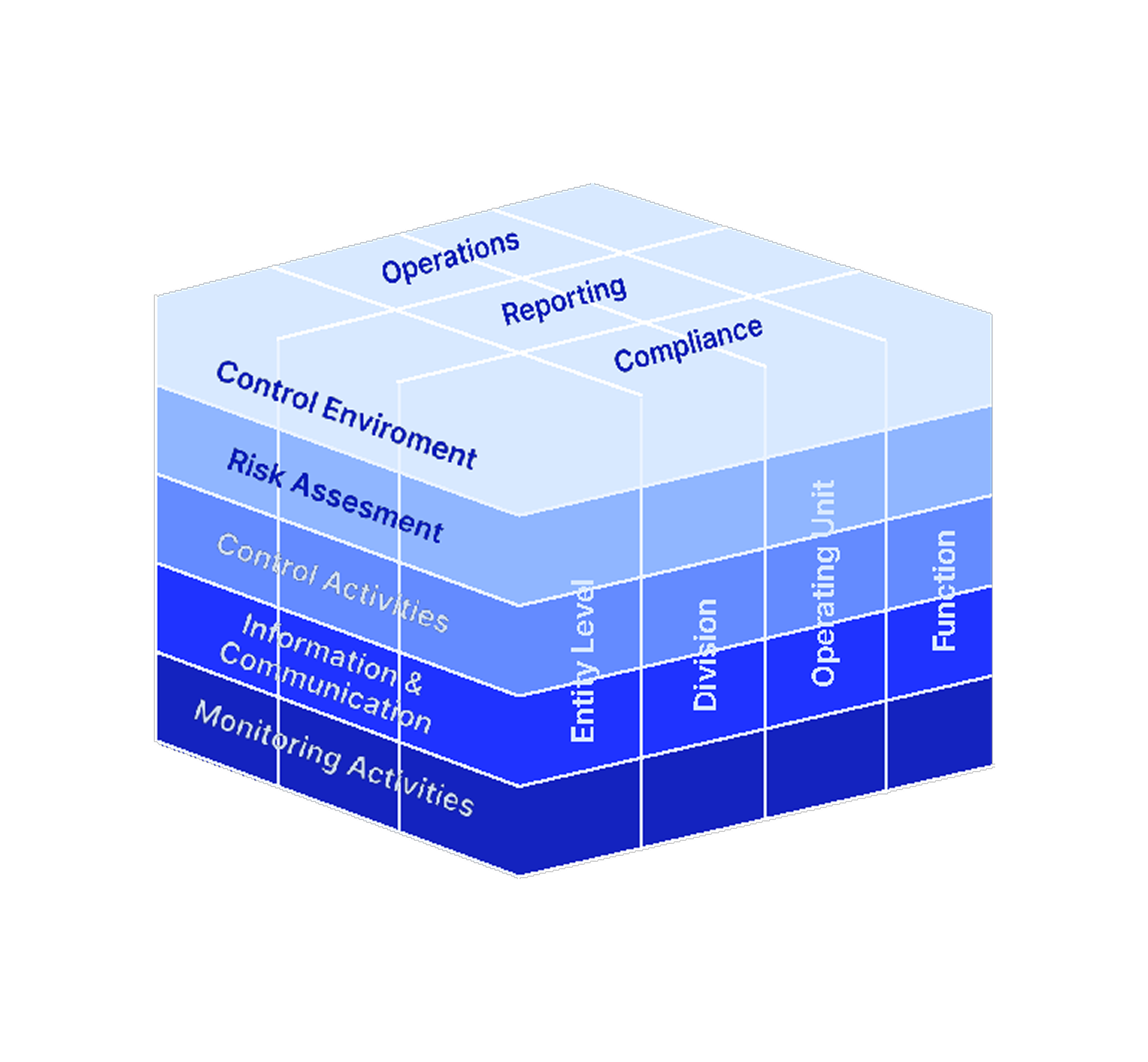

The COSO Cube

The COSO cube is a 3D visual representation of the COSO Internal Control-Integrated framework. It illustrates that adequate internal controls require attention to all three dimensions below simultaneously:

- Five Components of COSO Framework

- Controls Objectives

- Organization Levels

Let’s look into each of the dimension one-by-one.

a. Five Components of COSO Framework

COSO Framework has the five components as below:

| Components of COSO Framework | Description |

|---|---|

| Control Environment | The set of standards, processes, and structures that provide the basis for carrying out internal control across the organization |

| Risk Assessment: | The process of identifying and assessing risks that could be potential threats to achieving organizational goals and how to manage these threats. |

| Control Activities: | Policies and procedures that help ensure management directives are carried out and actions are taken to address the risks, such as authorization, reconciliation, performance reviews, and segregation of duties. |

| Information and Communication | The process of accurate identification and exchange of information to support the functioning of internal controls, including effective communication channels to ensure individuals understand their roles and responsibilities regarding internal controls. |

| Monitoring Activities | Monitoring activities to assess the quality of internal performance over time through ongoing evaluations, separate evaluations, or a combination of both. |

b. Control Objectives

Organizations strive to achieve control objectives through their internal controls, and the cube structure shows that all five components should be present and function effectively for each of the three objective categories. For example:

- the control environment for financial reporting emphasizes accounting expertise and ethical behavior,

- Risk assessment for operations focuses on market risks and operational efficiency,

- Control activities for compliance include regulatory reporting procedures and legal review processes.

c. Organizational Levels

The third dimension of the cube illustrates that internal control can be applied at various levels within an organization.

- Entry level: Controls that apply to the entire organization, such as code of conduct and ethical guidelines, a centralized risk management function, and period-end financial reporting processes.

- Division/operating unit level: Functional controls addressing risks within specific business divisions, such as Human Resources control, i.e., hiring, payroll, performance management.

- Function level: The most detailed level controls embedded in specific business processes, such as IT systems, procurement processes, sales processes, and physical asset safeguarding protocols.

Emerging Extensions

The 2023 COSO guidance on Internal Controls over Sustainability Reporting (ICSR) represents a significant extension of the traditional COSO framework to address the growing importance of environmental, social, and governance (ESG) reporting in corporate accountability.

COSO regularly provides industry and technology-specific guidance that helps organizations apply the framework to contemporary challenges.

- Healthcare COSO guidance emphasizes the integration of patient safety considerations into internal controls, implementation of controls to secure Protected Health Information (PHI), medication safety, and adverse event reporting, clinical quality measurement, and improvement.

- Blockchain Technology guidance addresses risks related to smart contracts, ledger integrity, controls related to secure storage and access to private keys, and managing responsibilities in decentralized systems.

- COSO guidance on Robotic Process Automation (RPA) explains the integration of controls into automated workflows to reduce human errors or manipulation, ensuring input data meets automation requirements, and managing situations that fall outside the computerized perimeters.

The Five Pillars and Seventeen Principles of COSO

Control Environment

The Control Environment is the foundation of the COSO Internal Control integrated framework, setting the tone of an organization and influencing every aspect of its operations.

- Integrity & ethical values

This principle emphasizes a strong ethical culture, with a commitment to honesty, fairness, and ethical behavior, thereby fostering a reliable control environment. A code of conduct should be established that communicates ethical behavior and prohibited actions, and enforces disciplinary actions against violations. Senior leadership actions and decisions must be consistent, and this is reinforced by a code of conduct that sets the standard by example.

- Independent board oversight

An effective internal control system requires active and independent governance and oversight from the organization’s board of directors. A significant proportion of board members, particularly those serving on key committees such as the audit committee, should possess relevant expertise and knowledge of business, and should not hold any management positions. The board should regularly conduct reviews of risks, compliance, and internal audit findings, and oversee the implementation and effectiveness of internal controls and financial reporting by management. Independent board oversight increases transparency and reduces the risk of management override or conflict of interest.

- Defined structure, authority & responsibility

For internal controls to be adequate, there must be a clear organizational structure that establishes a clear line of authority, a reporting hierarchy, and a clear understanding of responsibility and accountability. An organization chart defines the structure, including departments, divisions, and reporting relationships. The authority matrix defines who has the authority to make specific decisions, such as approving expenditure limits, signing contracts, and preventing unauthorized actions. Job descriptions for each position define the responsibilities and duties associated with it. Segregation of duties ensures that authorizing and recording transactions are separated among different individuals to reduce the risk of fraud and error.

- Competent personnel recruitment & development

Competent personnel are the foundation of adequate internal controls, as controls are ultimately designed, implemented, and operated by people. The requirement and development of competent personnel must be strategically aligned with the organization’s objectives and control requirements. An effective recruitment and selection process should be implemented to identify candidates who possess the required skills, experience, and integrity. Providing ongoing training and professional development opportunities to ensure that employees have the necessary knowledge and skills to perform their control responsibilities. Conduct regular performance reviews and develop succession plans to ensure continuity of control function when key personnel leave the company or change roles.

- Accountability for control responsibilities

Individuals should be held responsible for their internal control responsibilities through performance measurement and control enforcement mechanisms. Integrating control responsibilities into job descriptions and performance evaluations ensures that adherence to control procedures is a measurable aspect of an employee’s performance, and that incentives or disciplinary actions are mapped accordingly. Implement a reporting mechanism that enables the monitoring of a control’s performance and facilitates a prompt investigation in the event of deviation.

Risk Assessment

Risk assessment is the second component of the COSO framework, focusing on identifying, analyzing, and responding to risks that could impact the achievement of objectives.

- Specific objective setting

Clearly defined objectives provide a basis for identifying and assessing risks. This principle emphasizes that objectives should be specific, measurable, achievable, and time-bound to enable effective risk identification and control design. Define strategic goals that support the organization’s mission and vision, and operational goals that provide insight into the effectiveness and efficiency of operations. Reporting objectives deliver reliable, transparent internal and external financial reporting on time, and compliance objectives for adherence to laws and regulatory standards.

- Risk identification & analysis

Once objectives are set, the organization must systematically identify potential risks that could prevent the achievement of those objectives and analyze their potential impact and likelihood. Techniques such as SWOT analysis (strengths, weaknesses, opportunities, threats), PESTLE Analysis (Political, Economic, Social, Technological, Legal, Environmental), and Risk Register to catalog identified risks along with relevant attributes (owner, status, rating, etc.) are used to identify risk factors. Once risks are identified, they are analyzed to understand their characteristics, such as probability of occurrence, potential impact if they occur, and prioritizing risk mitigation based on their likelihood and impact.

- Explicit fraud consideration

The COSO framework requires an explicit evaluation of fraud risk when assessing risks to achieving objectives. Considering different types of fraud, including asset misappropriation, theft of cash and inventory, financial reporting fraud, and corruption in the form of bribery and kickbacks. Assessing the risk that management might override existing controls, and how two or more individuals collude to bypass controls to commit fraud. Brainstorming fraud schemes that could occur within an organization’s operations and processes with internal controls enabled, such as how sales revenue could be overstated, how expenses can remain hidden, or how sensitive data could be misused.

- Anticipation of change

This principle emphasizes the importance of an organization proactively identifying and assessing changes in the market, technology, or regulatory laws that could significantly impact its internal control system. Continuously review risks that can emerge due to internal changes, such as changes in leadership or key personnel, organizational restructuring, or ownership changes resulting from mergers, acquisitions, or shifts in workforce demographics. Risks that could emerge due to external changes, such as revised regulatory requirements (e.g., data privacy laws), economic shifts (e.g., recessions, acute inflation), supply chain disruptions, technological advancements, or natural disasters.

The annual risk assessment report should document the top risks, control weaknesses, emerging trends, their severity, and key conclusions. A risk inventory should be maintained with periodic reviews to keep risks prioritized by their likelihood and impact scores. Risk mitigation plans should be developed with specific actions to be taken to reduce the likelihood or impact of the risk. Responsibilities should be assigned to individuals with metrics for measuring practical actions, monitoring progress, and efficiency.

Control Activities

Control activities are the policies, procedures, and mechanisms implemented to mitigate risks and achieve organizational objectives. They are the “actions” of internal controls, detailing the specific steps taken to address the identified risks.

- Activities to mitigate risks

This principle emphasizes that organizations must select and develop control activities that directly contribute to mitigating the risks identified during the risk assessment phase. Management considers various factors when selecting control activities, including the nature and impact of risk, the cost-benefit relationship, and the effect on operational efficiency. Control activities must include proper mechanisms for approval, verification, reconciliation, segregation of duties, and access restriction, and address all significant business processes and functions such as operational, financial reporting, and compliance risks.

- Technology controls aligned to objectives

This principle focuses on aligning technology-related control activities with the organization’s overall objectives. General IT controls include control over data center and network operations, software implementation and maintenance, access security, application systems deployment, and maintenance. Systematic identification and implementation of mitigation strategies for technology-related risks such as cybersecurity threats, system failures, data breaches, disaster recovery, and business continuity plans.

- Policies & procedures define required activities

Well-documented policies and procedures translate management directives into actionable control activities that guide employees on when specific actions are needed, who should execute controls, and how to perform defined procedures effectively. Policies define standards and clarify roles and responsibilities, procedures ensure consistency, guidance, and metrics for how controls should be executed. Effective communication and training ensure that employees understand procedures and responsibilities, enabling them to perform control activities efficiently and effectively.

Different types of control activities provide different perspectives on their function and implementation:

- Preventive controls: Designed to prevent errors, fraud, or irregularities before they occur, such as access control, code review, and approvals.

- Detective controls: Designed to identify issues after they have occurred, such as the reconciliation process, exception reporting, and log monitoring.

- Corrective controls: Designed to correct problems after they are identified, such as incident response, system patches, and recovering data from backup.

Manual controls require human intervention and are suitable for judgment-based tasks, such as managers’ approval for business travel requirements and expenses. Whereas automated controls are embedded in information systems and operate automatically based on preconfigured logic, for instance, system-enforced access restrictions and password complexity policies.

Information and Communication

The information and communication of the COSO framework ensure that relevant and high-quality data is captured, processed, and shared promptly across the organization and with external stakeholders.

Quality data (relevant, timely, accurate, accessible)

High-quality data is crucial for supporting the functions of internal control, decision-making, and risk mitigation. Data should directly support the internal control objectives and operational needs. Irrelevant data can lead to confusion and misdirection. Information must be delivered on time for effective decision-making and for control to operate efficiently.

Delayed information can lead to missed opportunities or unaddressed risks. Information must be correct, complete, and free from human error or bias to avoid incorrect conclusions and poor decisions.

Information must be readily available to those who need it in a format they can understand and utilize effectively, which typically requires efficient information systems and a precise reporting mechanism. Establish policies, procedures, and controls for data management throughout its lifecycle, encompassing data creation, collection, processing, storage, and maintenance. Integrate various information sources and systems to provide complete and consistent data across multiple business units.

Internal communication of responsibilities (upward, downward, lateral)

Internal communication ensures that control responsibilities, expectations, and changes are effectively conveyed throughout the organization, allowing everyone to understand their role in the internal control system.

- Downward communication enables management to communicate objectives, policies, procedures, and expectations regarding the performance of internal controls.

- Upward communication allows employees to communicate internal controls design or implementation issues, exceptions, or suggestions for improvement to management or the audit committee.

- Lateral communication helps employees share information across different departments or operating units for activities coordination, best practices, and addressing operational issues.

External communication with stakeholders

External communication refers to the exchange of information with external stakeholders to ensure transparency, accountability, and compliance with internal controls and regulations. Public companies are required to provide regular and accurate financial reporting to investors, including financial statements, annual reports, and disclosures of material risks.

Communicate with regulatory authorities to submit reports and required evidence to meet regulatory compliance requirements. Establish proper channels to communicate with customers regarding products, services, policies, and any issues that may affect them. Ensure regular communication with suppliers, vendors, and business partners regarding contract terms, performance standards, compliance requirements, and issue resolution.

Organizations must establish clear protocols for notifying relevant parties when a security incident, control failure, or data breach occurs. These protocols should specify the types of incidents that require notification, who must be notified, the timeframe for notification, and the required content of the notification.

Controls Monitoring Activities

Monitoring is crucial to ensure that internal controls remain effective over time. The goal is to identify and correct control deficiencies before they become significant problems and controls continue to operate effectively as business conditions, objects, and risks evolve.

- Ongoing or periodic evaluations

This principle emphasizes that an organization must select, develop, and conduct evaluations, either ongoing or separate assessments, or a combination of both, to determine whether the components of internal controls are present and functioning effectively. Ongoing evaluation checks are built into the normal operating activities of a business function and provide real-time or near real-time feedback on the effectiveness of internal controls, usually conducted by a supervisor, manager, or automated systems. Separate Evaluations are undertaken periodically by individuals who are objective and competent, such as internal or external auditors, conducting an annual audit of financial reporting controls or quarterly risk-based compliance assessments.

- Timely reporting of deficiencies to accountable parties

When internal control deficiencies are identified through monitoring activities, they must be carefully evaluated and communicated to relevant stakeholders on time to facilitate corrective actions. Once a control deficiency is identified, its severity and potential impact should be assessed in relation to the achievement of objectives. Document and classify the effect of deficiency, i.e., minor or significant, and promptly notify the corresponding level of authority. Delays in reporting can lead to prolonged exposure to risk. The objective of reporting is to ensure that identified weaknesses are not only recognized but also contained or eradicated in a timely manner.

Four‑Stage Implementation and Use Process

Planning

The planning phase establishes the foundation for successful COSO framework implementation by defining clear objectives, securing stakeholders’ commitment, and developing a comprehensive roadmap.

- Define why COSO is being adopted, for example, to improve financial reporting accuracy, enhance operational efficiency, or ensure regulatory compliance. These objectives should then be explicitly linked to the organization’s strategic roadmap and how the internal controls system supports the achievement of long-term business goals.

- Involve cross-functional stakeholders, i.e., finance, IT, HR, legal, and other business departments, in defining the scope and boundaries of control farmwork.

Large organizations with complex business functions and interconnected processes across different regions and markets often find that managing internal control activities manually can become inefficient quickly. Consider an automated solution for Governance, Risk, and Compliance (GRC), to centralize documentation, automate control activity tracking, manage risk assessments, and streamline reporting.

Evaluation and Documentation

This stage involves a comprehensive assessment of current internal controls and documenting existing policies and procedures.

Control maturity assessment evaluates the strength and effectiveness of current control activities against the five COSO components. Existing documentation, including policies, procedures, risk registers, control matrices, audit logs, and Enterprise Risk Management (ERM) artifacts, is collected.

The review process highlights areas with insufficient documentation, outdated policies, or missing controls. Identified gaps should be classified and prioritized based on risk impact and regulatory requirement.

Systematic tracking of documentation gaps should be implemented, including detailed gap inventories with precise descriptions and effects, assigned ownership and accountability for remediation, and target completion dates.

Remediation

The remediation stage focuses on developing and implementing comprehensive action plans to address identified control gaps and deficiencies.

- Define an action plan that includes detailed gap descriptions that identify the specific control deficiency or missing element, specify remediation activities with a clear description of tasks and deliverables.

- Designate individuals responsible for each remediation task with appropriate resources, define success criteria and metrics with completion timelines, and track progress.

- Prioritize high-risk remediation first, use project management tools to track and communicate progress with realistic workload management.

Testing and Reporting

The final phase ensures that controls are not only in place but operating effectively. Regular testing and transparent reporting provide confidence to stakeholders and help sustain continuous improvement.

- Design testing ensures that controls are appropriately designed to address identified risks and achieve control objectives, typically including a review of control documentation to ensure completeness and clarity.

- Operating effectiveness testing evaluates whether controls are functioning as designed and are being executed consistently and accurately over time.

- The results of monitoring activities, including ongoing and separate evaluations, and control testing, must be regularly communicated to relevant stakeholders.

- Routing reporting to management at all levels, such as department heads, senior leadership, board members, and audit committee members. These reports should highlight the performance of key controls, any identified deficiencies, progress on remediation plans, and the overall effectiveness of controls.

Pros and Cons of the COSO Framework

Advantages

The COSO framework has become a standard for designing, implementing, and assessing internal controls across various industries as it aligns perfectly with different regulatory requirements, particularly the Sarbanes-Oxley Act (SOX). Section 404 of SOX requires public companies to establish and maintain internal controls over financial reporting, with regular assessments conducted by management and external auditors. The COSO framework provides a structured approach to implementing internal controls and mechanisms for risk assessment.

COSO promotes the idea that adequate internal controls are not just about preventing fraud or errors, but also support the role of control activities in achieving operational objectives. This integration enables control activities to become an integral part of daily tasks and decision-making by linking operational effectiveness with internal controls.

COSO has published several white papers, case studies, and guidance documents, along with implementation toolkits and updated versions of the framework, which reflect emerging risks such as cyber threats, ESG, and AI. Organizations looking to implement or improve their internal control systems can access a wealth of knowledge base for interpreting framework principles to develop practical internal control activities.

Limitations

The COSO framework components and principles provide broader guidelines rather than specific procedures or techniques for implementing internal controls. Due to this lack of perspective, organizations must invest additional effort in translating these principles into specific guidelines, policies, and control activities.

The framework requires a certain level of maturity, expertise, and resource availability to design, document, implement, and continuously monitor internal control. Small and mid-sized organizations often lack dedicated internal audit departments, sufficient IT resources, or the specialized personnel needed to conduct thorough risk assessments and perform ongoing monitoring of control activities.

Comparative Landscape

- COSO vs. COBIT: IT governance focus.

COSO primarily focuses on internal control over financial reporting, operational efficiency, risk management, and regulatory compliance requirements. While it acknowledges the importance of information technology in achieving organizational objectives, its approach is more general, viewing IT as a tool that supports overall business and internal controls.

Whereas Control Objectives for Information and Related Technologies (COBIT) is specifically designed for IT governance and management. COBIT addresses control objectives for the implementation of information, infrastructure, and applications, focusing on IT-related risks and how IT can contribute to improving control activities. Organizations often use COBIT to implement IT-related aspects of COSO control activities and support information and communication components of COSO.

- COSO vs. ISO 31000: Risk‑management orientation.

The COSO Enterprise Risk Management (ERM) framework offers principles and guidance for organizations to manage risks and opportunities effectively.

ERM defines risk as the possibility that an event will occur and can affect the achievement of objectives. It offers processes to identify, assess, and respond to these risks through continuous monitoring, thereby eliminating hurdles to achieving business objectives.

ISO 31000 is an international standard that provides principles and generic guidelines on risk management applicable to any organization regardless of size, industry, or complexity of operations. It offers a set of common principles and a framework for designing, implementing, and continually improving risk management. It emphasizes the integration of risk management into all organizational activities and decision-making processes.

The COSO ERM framework provides a risk-informed decision-making philosophy that is integrated with strategic planning and performance management. In contrast, ISO 31000 provides a more process-based approach to establishing and monitoring risk management practices.

Organizations can utilize COSO ERM to structure their overall risk management program, leveraging ISO 31000 principles for specific risk assessments and integration into various processes.

- COSO vs. Basel Framework: Banking-specific capital & risk standards.

Basel Framework, developed by the Basel Committee on Banking Supervision (BCBS), is a regulatory standard, primarily focused on risk-weighted capital requirements, market and operational risks, and supervisory review in the banking sector.

The Basel framework focuses on credit risk, market risk, operational risk, and liquidity risk, with quantitative requirements in place. In contrast, COSO focuses on comprehensive enterprise risks, including strategic, operational, reporting, and compliance risks.

The banking sector can leverage the strengths of both frameworks to enhance its operations. The Basel framework provides specialized and detailed regulatory standards for the banking industry. In contrast, the COSO framework guides internal control design, while the ERM framework offers a comprehensive approach to risk management.

- Choosing a Framework: Industry context, regulatory drivers, potential integration.

Choosing a framework or integrating multiple frameworks depends on several factors. Organizations can choose frameworks specially designed for them or mix different aspects of frameworks to leverage the maximum benefit.

- Industry context: Financial institutions can choose Basel for specific procedures handling capital and risk management, but can also use COSO for broader internal controls and ERM.

- Regulatory Drivers: Public trading companies, especially in the US, can choose COSO as it aligns particularly with SOX Act requirements for internal control over financial reporting.

- Potential Integration: Organizations can use layered approaches, leveraging COSO to provide general guidance for overall internal control, with COBIT providing detailed IT controls and ISO 31000 guiding the general risk management practices.

Benefits of Strong COSO-Based Controls

- Enhanced internal controls & fraud deterrence.

A strong COSO framework of internal controls provides multiple layers of protection against fraudulent activities and operational failures, embeds accountability in processes, and promotes an ethical culture with leadership’s tone at the top. Segregation of duties and authorization protocols ensure that no single person has control over an entire process. Detective controls, such as regular reconciliations, analytical reviews, and exception reporting, help identify unusual patterns and make it more difficult for fraud or collusion to occur.

- Improved risk anticipation and business continuity.

COSO’s integrated risk assessment processes help organizations identify, assess, and mitigate threats before they escalate, transforming reactive risk management into a proactive risk anticipation mechanism aligned with organizational objectives. Systematic risk identification promotes structured risk assessment using tools such as risk registers and impact likelihood matrices, thereby linking risk management to operational performance and continuity planning. Continuous monitoring activities, combined with regular reviews of key risk indicators and performance metrics, serve as an early warning system for emerging risks, enabling management to take corrective actions before they escalate into major problems.

- Strengthened regulatory compliance (e.g., SOX).

COSO provides a comprehensive framework for meeting complex regulatory requirements, particularly its systematic approach to internal controls, which aligns perfectly with the Sarbanes-Oxley (SOX) Act. Its emphasis on detailed documentation and testing of internal controls over financial reporting enables clear accountability for control ownership and performance. Helps in avoiding regulatory fines, penalties, or reputation damage, and facilitates audit readiness through transparent and standardized processes.

- Better, data-driven decision‑making; stakeholder confidence.

COSO-based controls ensure the reliability and integrity of financial and operational data, providing management with accurate and timely information. Control activities, such as data entry, reconciliation, and validation checks, ensure that the information used for decision-making is reliable and that financial statements are accurate, complete, and free from material misstatement. Improved visibility into financial and operational performance increases investors’ and stakeholders’ confidence.

Common Implementation Challenges & Mitigations

- Organizational Resistance

The workforce may view new controls as a threat to autonomy, an increased workload, barriers to operational efficiency, and a sign of distrust from management. Leadership must actively explain the strategic importance of COSO and its commitment to successful implementation to achieve business objectives. Educate employees on control responsibilities, benefits, and regulatory compliance requirements, and establish two-way communication channels to refine processes and address concerns.

- Knowledge Gaps

Implementing the COSO framework requires a conceptual and in-depth understanding of its components, principles, and their applications. Organizations often face a challenge where key personnel, from leadership to operational staff, may lack the necessary expertise, resulting in ineffective design or implementation of controls. Organizations must invest in formal training programs, encourage professional certification for key personnel, and define a knowledge-sharing mechanism for best practices to learn from each other’s experiences in COSO implementation. Involve external consultants to provide strategic advice on tailoring the COSO framework to the organization’s specific needs, and obtain expert opinions on methodologies, tools, and templates for conducting risk assessments, designing controls, and documenting procedures.

- Framework Integration

Organizations typically have existing processes, technologies, and risk management practices when considering the implementation of COSO, and a significant challenge arises from integrating the framework with these existing systems. Conduct a thorough assessment to understand the current state of controls and identify where they align or deviate from the COSO framework. Invest in building a comprehensive governance, risk, and compliance (GRC) model that serves as a central platform for risk management, internal control documentation, policy management, audit management, and compliance tracking. Involve all teams, IT, HR, compliance, and business operations to design and integrate COSO controls into existing processes.

Future of Internal Controls with COSO

Today’s organizations are facing a continuously evolving business landscape shaped by accelerated digitalization, regulatory requirements, and the expectations of stakeholders. Internal control, guided by the COSO framework, must evolve to remain effective.

The COSO framework is adapting to digital transformation, cybersecurity threats, and supply chain risk by integrating them into its core components and principles. COSO guides the design of controls that consider the risks inherent in decision-making algorithms, data integrity in distributed ledgers, and secure access to cloud environments. Cybersecurity controls are embedded in all control categories, rather than being treated as a separate technical domain, encompassing controls related to data privacy, incident response, network security, and access management. Controls are extending beyond enterprise boundaries and now involve tracking of geopolitical instability, natural disasters, ethical concerns, governance practices, and disruption in logistics throughout the supply chain network.

Stakeholders and regulators increasingly demand transparency in environmental, social, and governance (ESG) performance. COSO’s latest guidance emphasizes the importance of control over ESG data reliability, material assessments, and ethical sourcing practices. The ERM framework is increasingly used to connect sustainability risks to strategic objectives.

Traditional periodic internal control assessment is becoming insufficient and inefficient in a rapidly changing business environment. The future demands continuous monitoring and adaptive control systems that provide real-time insights and automatically adjust to emerging risks, responding to change dynamically. AI-powered analytical engines will identify emerging risk, develop remediation policies, and controls will self-tune and adapt based on contextual risk level or system behavior.

FAQs

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) is a comprehensive framework for enterprise risk management, internal controls, and fraud prevention. Its primary purpose is to enhance organizations’ governance, risk management, operational effectiveness, reliability of financial reporting, regulatory compliance, and implementation of internal controls aligned with strategic objectives

Control Environment: The overall tone at the top, ethical values, integrity, and commitment to competence within the organization.

Risk Assessment: systematic identification and analysis of risks that could affect the achievement of objectives.

Control Activities: The actions taken to address the risks under the policies and procedures defined by management.

Information and Communication: The ongoing process of obtaining and sharing quality information, both internally and externally, to support the accurate functioning of internal controls.

Monitoring Activities: ongoing evaluation and separate evaluation or combination of both to verify that components of internal controls are present and functioning.

Implementation of the COSO framework typically involves the following steps:

Planning and scoping: Define the project scope, secure a leadership sponsor and allocate resources, form the team, and develop an implementation timeline.

Current State Assessment: Evaluate existing internal controls against the COSO framework’s principles to identify strengths and weaknesses.

Design and Remediation: Design new controls or enhance existing ones to address identified gaps and empower the control environment.

Implementation: Integrate controls into operations, linking them with business processes and systems, and train the workforce to execute control activities efficiently.

Testing and validation: Test that controls are operating as designed and generating results as expected.

Reporting and monitoring: Establish a document control environment, define performance metrics, and implement a reporting mechanism to continuously monitor ongoing efficiency and effectiveness.

Fraud prevention is a significant outcome of implementing the COSO framework. A strong control environment establishes a culture of integrity and ethical behavior. Risk assessment identifies and assesses fraud risks. Control activities implement preventive and detective measures. Information and communication ensure accurate and timely reporting. Monitor activities continuously, oversee and improve controls to detect and report fraudulent activities.

COSO Enterprise Risk Management (ERM) framework integrates risk identification and assessment processes across all organizational levels and functions. Classify risk by type, impact, and likelihood, incorporate risk perspectives from various stakeholders, and develop remediation strategies to be integrated with internal controls and achieve strategic objectives.

The Sarbanes-Oxley (SOX) Act requires publicly traded companies to establish and maintain adequate internal controls over financial reporting. COSO Internal Control-Integrated framework provides a structured approach to design, implement, evaluate, and report on the effectiveness of internal controls over financial reporting, directly addressing the SOX mandates.