This article provides a comprehensive summary of the Sarbanes-Oxley Act of 2002. It explains what the Sarbanes-Oxley Act of 2002 is and why the Sarbanes-Oxley Act was created, provides an Overview of SOX 11 Titles, and describes Key Sub-Sections under those Titles. It will also focus on explaining the historical context of SOX, its purpose, benefits, and impact on corporate governance.

What is the Sarbanes-Oxley Act (SOX) of 2002?

The Sarbanes-Oxley Act is a US federal law passed by Congress and the Senate in response to high-profile corporate scandals from the late 90s to early 2000, exposing major flaws in publicly listed companies’ financial reporting. It was a major overhaul of corporate financial reporting, mainly for public companies on the US stock exchange. It provided enhanced rules and regulations to increase transparency by implementing strong internal controls to ensure the reliability of financial statements. SOX law focuses on strict requirements for company executives and public accounting firms to restore investor trust, prevent fraud, and improve corporate governance.

The SOX (Sarbanes-Oxley) Compliance Act requires implementing new reporting standards for public accounting firms and corporate executives. These standards enhance transparency, accuracy, and accountability in financial reporting.

Key provisions of SOX Compliance are as follows:

- Company executives, CEOs, and CFOs are personally required to certify the accuracy of financial reports and take full responsibility for internal controls. They are also required to document, assess, and report to the Security Exchange Commission on the efficacy of internal controls.

- For public accounting firms, SOX legislation also enables strict regulations for auditors working for these companies to go under oversight by the Public Company Accounting Oversight Board (PCAOB). PCAOB requires the registration of accounting firms, inspecting those accounting firms, and reviewing their quality control policies and ethics standards. Investigate them for violations of regulations.

Private companies are generally exempt from SOX, except if they plan to go public, are acquired by a public company, or interact with public companies in ways that require SOX compliance. Many private companies also choose to adopt SOX standards to improve their financial integrity or prepare for future public listing.

Purpose of Sarbanes-Oxley Act

The purpose of the Sarbanes-Oxley Act was to:

- Require accurate financial reporting and establishing internal controls to prevent fraudulent activities within corporations. Certify top-level officials personally responsible for financial statement integrity.

- Require organizations to maintain an effective internal control system to ensure the accuracy of accounting, auditing, and financial reports by developing improved auditing standards for the reliability of financial disclosures.

- Introduce supervision controls like the Public Accounting Oversight Board (PCAOB) to regulate the auditing processes and align with SEC regulations, especially Section 404 and sub-sections, as there were reforms to increase the effectiveness and efficiency of Section 404 implementation in 2007.

SOX imposes severe penalties for non-compliance. These penalties serve to discourage companies and top officials from engaging in fraud and create a better corporate culture and ethical practices.

- Executives who knowingly submit false certifications of financial reporting could face fines up to $5 million or imprisonment for up to 20 years.

- Not adhering to strict reporting requirements of the SOX Compliance Act can result in increased civil penalties of the Employee Retirement Income Security Act of 1974 (ERISA) and new criminal penalties by the SOX Act, which holds auditors and company executives accountable for transparency of corporate reporting and accuracy of financial information.

The key provisions of the SOX Act for penalties are:

- Section 802 for altering documents knowingly,

- Section 807 for defrauding shareholders of publicly traded companies,

- Section 906 for noncertification of the reports by top officials and

- Section 1106 for increased penalties.

SOX regulations, like the creation of PCAOB to keep an eye on corporate governance, auditing, financial reporting, and risk management, make sure that companies are governed by independent and accountable boards, maintaining certification of financial integrity, regular assessments, and internal SOX controls. These regulations work together to create a reliable financial environment by reducing fraud and restoring public trust in the governance of a corporation and ended more than 100 years of accounting firms and corporations regulation.

History of SOX

In the late 1990s and early 2000, many corporate scandals like Tyco International, Enron, and WorldCom revealed a widespread failure in governance, unethical accounting practices, and financial frauds, which reduced investor confidence and caused significant economic damage. In the wake of these scandals, the Sarbanes Oxley (SOX) Act was designed and passed to overcome these issues by implementing strong regulations on companies, executives, and auditors to hold them responsible for their actions in increasing transparency in financial reporting.

Enron Corporation (2001)

Enron, a major energy company, used deceptive accounting and off-balance sheet entries to conceal massive debts and report false profits. After a whistleblower exposed the truth, the company’s stock prices dropped from $90.75 to $0.26. The scandal led to financial losses, job losses, and bankruptcy.

Tyco International 2002

Tyco International inflated earnings and mismanaged corporate funds. CEO Dennis Kozlowski was sentenced to prison for fraud and theft. The scandal highlighted the need for stronger internal controls and transparency in financial reporting, leading to the implementation of Section 404 of the SOX Act.

WorldCom Scandal 2002

WorldCom falsely capitalized expenses and inflated earnings by over $11 billion. CEO Bernie Ebbers was convicted of misrepresenting financial reports. The scandal led to the company’s bankruptcy. This highlighted the need for improved audit oversight, ultimately creating PCAOB.

Adelphia Communications (2002)

Adelphia Communications hid debts to obscure financial troubles and misappropriated funds for luxury purchases. They filed for bankruptcy in 2002, resulting in billions in investor losses and penalties. SOX provisions enforced real-time disclosures and transparency in related party transactions and off-balance sheet reports.

Peregrine Systems (2002)

Peregrine Systems inflated earnings through fraudulent sales, which misled investors and analysts. The scandal led to fines, bankruptcy, financial losses, job losses, and diminished investor trust.

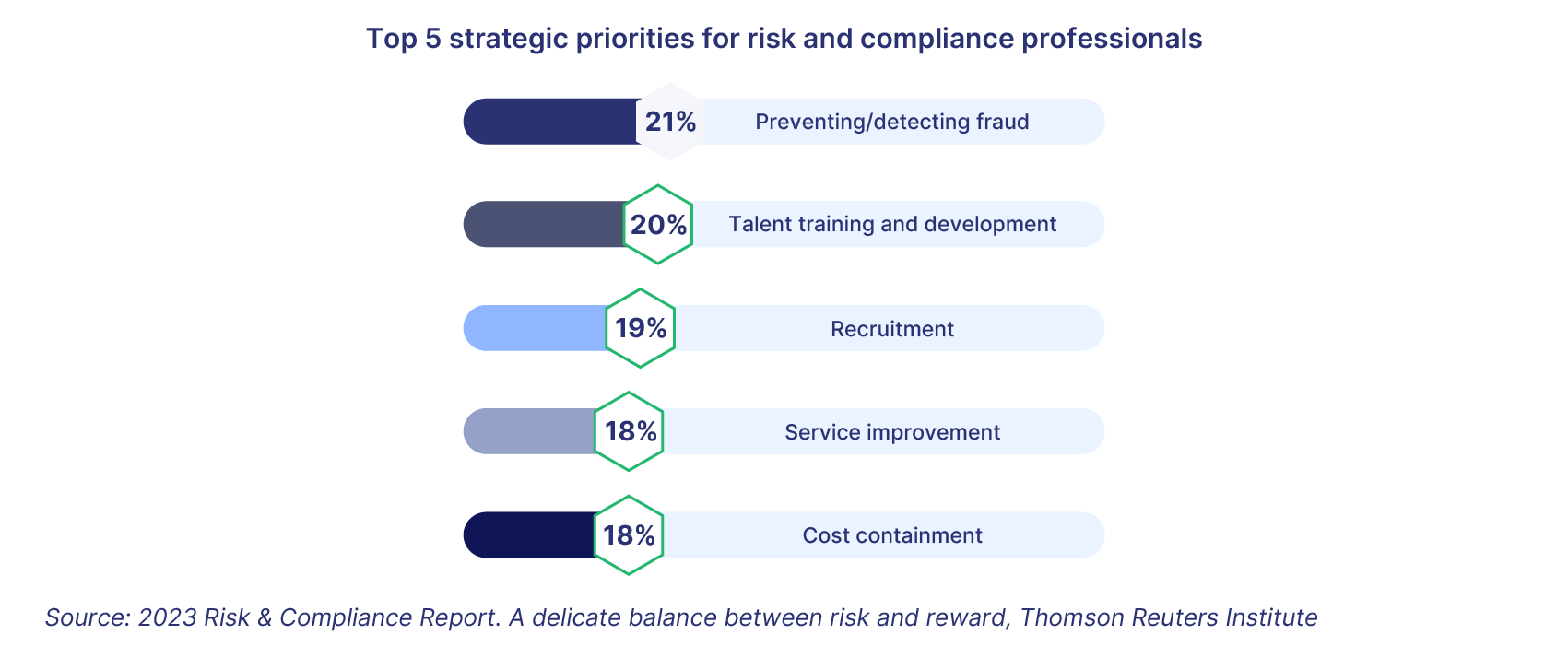

SOX Impact on Restatements of Financials

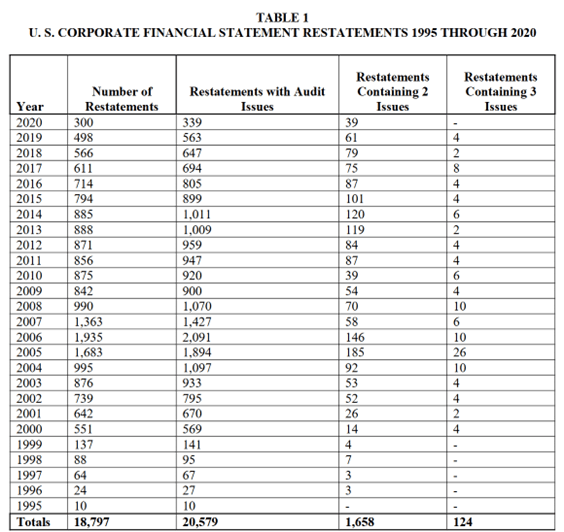

When companies discovered their previously reported financial statements had errors or misstatements, they issued restatements containing correct financial information. Restatements increased 66% in 2005 as companies corrected their financial reports to comply with new section 404 of SOX Compliance, which required internal control assessments.

In 2006, restatements increased as companies and auditors reviewed their financial statements for mistakes and issues regarding accounting practices or internal control systems. By 2009, restatements decreased, reflecting the long-term effect of familiarity with and benefits of SOX compliance, which improved the internal control and financial system reports.

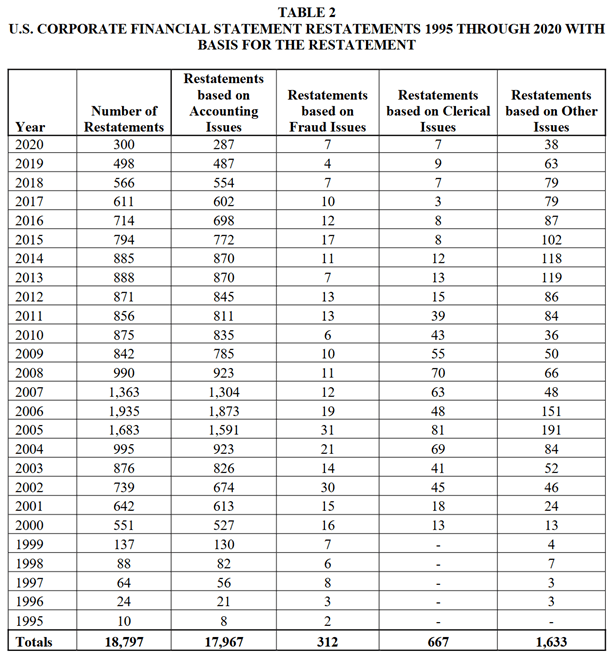

Below are two tables showing the increase and decrease in restatements from 1995 to 2020. These tables show several restatements containing several issues, their nature, etc.,

Source: Article Gateway

Source: Article Gateway

Types of Restatements

Restatements are classified into 4.02 Restatements and Non-4.02 Restatements based on material errors and their impact on financial statement reliability.

4.02 Restatements

These involve material errors in filed financial reports that can mislead regulators, investors, and analysts for investment, business operations, or lenders. Governed by the SEC’s Regulations S-X section 4.02, these restatements include asset misstatements, incorrect accounting procedures, or incorrect revenue recognition. A prime example of 4.02 Restatements is companies showing their revenue by billions due to incorrect revenue reporting.

Non-4.02 Restatements

These are correcting minor issues like clerical mistakes that don’t materially impact financial reliability and do not mislead investors. Non-4.02 restatements are not as severe as 4.02 restatements, but they still could affect a company’s reputation.

Components of Sarbanes-Oxley Act 2002

The Sarbanes-Oxley Act 2002 has eleven titles, along with sub-sections under each title that will be discussed later in this article:

- Title I: Public Company Accounting Oversight Board (PCAOB)

- Title II: Auditor Independence

- Title III: Corporate Responsibility

- Title IV: Enhanced Financial Disclosures

- Title V: Analysis of Conflicts of Interest

- Title VI: Commission Resources and Authority

- Title VII: Studies and Reports

- Title VIII: Corporate and Criminal Fraud Accountability

- Title IX: White Collar Crime Penalty Enhancement

- Title X: Corporate Tax Returns

- Title XI: Corporate Fraud Accountability

Title I: Public Company Accounting Oversight Board (PCAOB)

The Public Company Accounting Oversight Board (PCAOB) is a nonprofit organization that governs public accounting firms that offer audit services to publicly traded companies. It is a neutral arbiter of audit quality that operates independently of the Securities Exchange Commission.

PCAOB monitors public companies’ audits to increase their quality and ensure transparency in financial reporting. PCAOB inspects auditors, imposes fines, and can cancel an auditing firm’s registration or stop it from auditing public companies. Inspections ensure compliance with the Generally Accepted Auditing Standards (GAAS) of the United States.

The primary responsibilities of PCAOB are:

- Require accounting firms’ registration, which audit the publicly traded companies.

- Inspect these accounting firms.

- Establish audit quality control and ethical standards for registered firms.

- Investigate violations of regulations and discipline of registered firms and associated persons.

PCAOB also updates the standard when financial reporting practices or business requirements change. To impose financial reporting standards, PCAOB collaborates with other regulatory bodies, such as the Financial Accounting Standard Board (FASB) or the American Institute of Certified Public Accountants (AICPA).

Read More: SOX Audit: 8 Steps to a Success Audit

Title II: Auditor Independence

This title aims to empower auditors and foster their independence. Unbiased or untrustworthy audit results can create conflicts of interest and can undermine the reliability of a company’s financial statements. Such conflicts may arise from auditors’ close relationship with their clients and can shake investors’ trust in financial reporting.

According to SOX Title II:

- To guarantee that the auditing procedure is impartial and up to date, the lead and reviewing audit partners must rotate the engagement after five years to keep auditors from becoming overly attached to or engaged in the companies they audit.

- External auditors are not allowed to provide non-auditing services to the same customers they are auditing.

- To guarantee a transparent relationship between companies and their audit firms, audit companies must get approval from the board of directors of the audit committee to perform non-audit services.

- An employee of an auditing firm can’t be employed by the company being audited for at least one year to avoid influencing the audit process.

Title III: Corporate Responsibility

Title III holds senior executives accountable for financial reporting integrity. CEO and CFO should personally certify the accuracy of financial statements annually.

- Executives must confirm that the reports have no errors and that the financial statements accurately represent the company’s financial status.

- Knowingly approving false reports can lead to severe criminal consequences, such as civil penalties, fines, and jail time.

- Executives must maintain internal controls over financial reporting (ICFR) to guarantee the financial reporting process’s accuracy.

- Section 304 of Title III also requires CEOs and CFOs to return any bonuses or compensation in cases of misconduct.

- SOX also requires the creation of independent public audit committees as the company’s board of directors; these committees and directors should be independent and have no direct financial interest in the company.

Title IV: Enhanced Financial Disclosures

Title IV enhances financial transparency, requiring details about off-balance sheet transactions, pro forma financial numbers, and office stock transactions. It guarantees the accuracy of financial statements and the company’s financial situation so that investors get a complete and accurate picture of the company’s financial performance. An example could be disclosing special purpose entities (SPEs) or any consolidated subsidiaries frequently used by those fraudulent scandals.

Companies must also declare any serious flaws in their internal controls and address them quickly. In addition to the internal evaluation of the controls, external auditors must audit them and show them in the company’s annual audit report. Though PCAOB and SEC do not require any framework, they state that a company should follow the five components of internal control, which provide insight into monitoring, communication, information control activities, control environment, security and risk assessment.

Title V: Analysis of Conflicts of Interest

Title V provisions of the Sarbanes-Oxley Act address disclosure of conflicts of interest and a code of conduct for security analysts.

It requires the SEC to adopt rules for concerns regarding biased or misleading information in financial reports by financial analysts, security analysts, brokers, or dealers, which can be influenced by the relationship with the companies they are assessing and can lead to a conflict of advice.

Title V requires security analysts to follow a code of conduct to guarantee their independence and objectivity when evaluating a company.

Title VI: Commission Resources and Authority

This section aims to empower the SEC’s ability to oversee, enforce, and regulate the leading players in the securities market. Under these expanded authorities, the SEC regulates these professionals and firms engaged in improper or unethical professional conduct, willingly violating the standards or helping companies violate the regulations by not providing accuracy and transparency in their activities. This includes how they manage conflicts of interest, handle securities transactions, and interact with investors. Upon non-compliance, the SEC can temporarily or permanently deny their practices with the Securities Commission.

Title VII: Studies and Reports

Title VII requires several studies and reports by the Government Accountability Officer (GAO) and SEC to investigate and monitor several aspects of the securities industry for the identification of areas for potential improvements, such as consolidation of public accounting firms, securities laws relating to violations, or credit rating of agencies.

Title VIII: Corporate and Criminal Fraud Accountability

Title VIII requires increased corporate accountability regarding financial fraud. This includes protecting whistleblowers who report fraudulent practices in a corporation and are retaliated against by companies through discrimination, suspension, demotion, harassment, or termination.

Title VIII also defines the penalties for those who interfered in legal investigations and financial document manipulations. Whistleblowers could file complaints with the Department of Labor for retaliation and seek compensation or reinstatement for their jobs, lost wages, or any other legal remedies.

Title IX: White Collar Crime Penalty Enhancement

Title IX is focused on increased penalties for white-collar financial crimes, such as money laundering, securities fraud, and other financial crimes. The goal is to impose strong punishments for financial misconduct and ensure that people and firms engaged in fraudulent activities face more significant consequences.

Title X: Corporate Tax Returns

Title X of the SOX Compliance Act requires CEOs to personally sign the company’s tax returns, which ensures that CEOs are personally responsible and accountable for the accuracy of the company’s tax filings. This prevents misleading and inaccurate tax returns and reduces the chances of CEOs hiding or manipulating tax-related sensitive information, as they know they would face legal penalties and imprisonment in case of fraud.

Title XI: Corporate Fraud Accountability

Title XI also requires increased penalties for different types of corporate fraud and misconduct, especially for activities such as obstructing official proceedings, tampering with financial records, or involvement in fraudulent activities that affect the integrity of financial markets.

Title XI also grants the SEC extra authority to freeze large or unusual payments that could be linked to fraud or corporate misconduct.

Critical Sections of SOX for Professionals

Seven of the SOX Act sections below are considered critical when it comes to complying with the purpose of SOX:

Section 302: Corporate Responsibility for Financial Reports

Section 302 of SOX instructs the SEC to ensure that the CEOs and CFOs must sign and certify the periodic financial reports and make them public. These requirements include:

- thoroughly reviewing the report by the signing officer

- ensuring that the report does not contain any material fact or information that is not true

- ensuring that the financial statement shows the company’s correct financial condition and operational results.

The signing executives are also responsible for establishing and maintaining internal control systems to ensure material information is correct and that they have reported conclusions about the effectiveness of these internal controls. Any fraud discovered, material weaknesses, or deficiencies should be disclosed in their annual and quarterly reports.

Read More: What is SOX 302? | A Comprehensive Guide

Section 401: Disclosures in Periodic Reports

Section 401 requires that each annual or quarterly financial report filed by the company with the SEC should reflect all the material correcting adjustments, which have been externally audited by registered public accounting firms, following SEC rules and Generally Accepted Accounting Principles (GAAP).

These reports, in general, should disclose any material off-balance sheet transactions, obligations such as contingent obligations, arrangements, or any other statements that can affect a company’s current or future financial condition.

This section also requires that the pro forma information included should not contain misleading information, for example, pro forma figures, which can exclude some details or items to present an adjusted view of the company’s financial performance.

Section 404: Management Assessment of Internal Controls

SOX Section 404 is an essential provision of the Sarbanes-Oxley (SOX) Act, which requires management to ensure the effectiveness of internal controls over its financial reporting. It contains many sections for external auditors or management, but Sections 404(a), 404(b), and 404(c) are the critical ones.

Section 404(a)

The regulation requires companies to report on management’s responsibility for internal controls publicly and annually evaluate and document internal controls. The assessment process involves identifying any deficiencies in the controls to prevent fraud, errors, or misstatements in financial reports. The assessment report should be disclosed in the company’s Form 10-K filed with the SEC.

Controls related to information technology are especially critical, as most financial transactions occur digitally. Key IT-related practices include:

- Monitoring access to key business systems,

- Ensuring reliable data backup processes,

- Implementing robust file and document-sharing policies,

- Establishing measures to identify and address cyber threats.

Read More: SOX Testing | A Step-by-Step Guide

Section 404(b)

SOX requires companies to get external auditors to attest and report the assessment report filed by management for internal controls. The PCAOB oversees these auditors to ensure compliance with auditing standards, providing additional transparency to investors that a company’s financial reports are reliable.

Section 404(c)

Section 404 demands the external auditor attestation, which only applies to mid-size (accelerated filers) or large companies (large accelerated filers). Emerging growth companies (EGCs) or small businesses are exempt from these regulations (external auditors’ attestation), as they fall under separate rules required by the reforms made in 2007 in SOX or by JOBS law.

Though exempt from external auditors’ attestation, small companies must assess their internal controls and file Form 10-K. The exemptions were introduced to decrease the compliance burden for small companies.

In addition to annual findings, SOX-compliant companies must instantly report any confirmed or suspected cyber security incidents and data security breaches. This is reported using Form 8-K (or Form 6-K for Foreign Private Issuers) and must be submitted no later than four business days after discovering a material impact.

Section 409: Real-Time Issuer Disclosures

This section requires public companies under section 13 or 15 of the National Securities Exchange Commission Act of 1934 to disclose reports to the public about any material change in their financial condition or operation in real-time or as soon as possible, which will make sure that stakeholders and investors are informed with the changes, which could affect the financial performance and health of the company, and provide them the opportunity to decide whether to sell, buy or hold shares in that company. A material change could be an event such as regulatory changes, a significant loss, an acquisition of another company, litigation changes, or any other business activities that could impact the company’s financial review.

Section 802: Criminal Penalties for Altering Documents

This section amends Federal Criminal Law to impose stricter penalties. Anyone who knowingly alters, destroys, conceals, falsifies, covers up, or makes a false entry in any record or document in a bankruptcy investigation or Federal investigation will face fines and imprisonment of up to 20 years or both.

This section also increased the retention period for any work papers related to auditors’ review by ensuring that evidence or paperwork created by auditors is available for any future legal proceedings or investigations, which provides the integrity of the SOX audit process for reliability and accuracy of financial statements. According to new laws, these supporting documents and audit records must be retained for at least seven years.

Section 806: Sarbanes Oxley Whistleblower

This section provides increased legal protection from retaliation against employees of a company, including any agent, contractor, sub-contractor, or officer disclosing any fraudulent activity, violation of laws, or misconduct by contacting directly SEC, should not be discharged, demoted, suspended, threatened, harassed or discriminated against any other means in the terms and conditions of employment.

Under Section 806, obtaining a Non-disclosure Agreement (NDA) or severance agreement from employees is also forbidden, which could prevent them from reporting fraud or other misleading activities to the SEC and other authorities.

Section 906: Corporate Responsibility for Financial Reports

Section 906 also amends Federal criminal law and requires CEOs and CFOs to certify in writing that all periodic reports require financial disclosures or statements that comply with SEC requirements and show that a company’s financial and operational conditions are accurate and reliable.

If a CEO or CFO unknowingly certifies any statement containing false information or irregularities, the penalty is $1 million or imprisonment of not more than 10 years or both.

If the reports are signed knowingly and are misstatements, the penalty increases to a fine of up to $5 million and imprisonment of not more than 20 years or both.

The CEO and CFO of a company are required to conduct due diligence under section 906 as part of their review process of the financial reports; this includes relevant personnel interviews and internal employees involved in the financial reporting, e.g., the chief accounting officer and risk management officers.

For external people, such as auditors or accounting firm employees, engaged in the financial reporting process, the due diligence process also involves reviewing supporting documents to ensure that statements are reliable and accurate.

The requirement of due diligence ensures that CFOs and CEOs not only sign financial statements but also thoroughly review them, making fraudulent activities more difficult.

SOX and Corporate Governance

The Sarbanes Oxley Act notably makes corporate governance stronger by increasing the accountability of the company’s top officials, especially the Chief Executive Officer and Chief Financial Officer, to make financial reporting more transparent.

SOX requires CEOs and CFOs to personally certify financial statements as complete, accurate, and compliant with section 302 and section 906 accounting regulations. This holds them accountable for the company’s financial health and puts their freedom and reputation on the line.

CEOs and CFOs are also responsible for section 404, which directs the SEC to ensure that internal controls are implemented and are effectively working; this includes evaluating the documents and reporting on the pertinence of internal control systems. Executives are accountable for more than just making sure financial statements are accurate. They must proactively stop fraud, conflicts of interest, and other governance lapses. Executives are held responsible by SOX for the encouragement of a corporate culture that values moral behavior and openness in financial transactions.

Sarbanes-Oxley Act: A Comprehensive Summary

Below is a full list of all sections and subsections of the SOX Act to help provide a better understanding of the full scope provided by this regulation.

Title I: Public Company Accounting Oversight Board (PCAOB)

Title I of the Sarbanes-Oxley Act established the framework for thorough regulatory supervision of the auditing sector with the creation of the Public Company Accounting Oversight Board (PCAOB). The PCAOB has improved the quality of audits and the dependability and transparency of financial reporting for publicly traded corporations, with the power to inspect SOX audits, impose standards, and enforce compliance.

- Section 101: Establishes the PCAOB to oversee public company audits: Creates the PCAOB as a nonprofit organization that supervises and monitors audit-related matters for independent and accurate audit reports.

- Section 102: Requires registration of accounting firms: This section requires accounting firms to register with PCAOB to audit publicly traded companies.

- Section 103: Establishes auditing and quality control standards: Under this section, the PCAOB is required to create auditing and quality control regulations for registered accounting firms and requires them to retain auditing-related paperwork for at least seven years.

- Section 104: Mandates inspections of accounting firms: Directs PCAOB to conduct inspections of registered accounting firms to comply with the PCAOB and SEC rules.

- Section 105: Empowers investigations and disciplinary actions: This section authorizes the PCAOB to conduct investigations and impose disciplinary actions against accounting firms that fail to comply with SOX and SEC regulations.

- Section 106: Governs foreign public accounting firms: This section sets standards for foreign public accounting firms that provide auditing services and reports to US public corporations and must comply with SOX.

- Section 107: Grants SEC oversight of the PCAOB: Provides extended authority to SEC over PCAOB rules and regulations.

- Section 108: Establishes accounting standards: Amends the Securities Act of 1922 to allow the SEC to recognize accounting principles and standards set by a designated standard-setting body, such as GAAP.

- Section 109: Directs PCAOB to establish annual accounting support fees from issuers: Sets a fee structure for PCAOB through support fee collection by annual accounting reports.

Title II: Auditor Independence

The fundamental goal of Title II of the Sarbanes-Oxley Act is to increase auditor independence to maintain a lack of conflicts of interest. Title II restricts some non-audit services and partner rotation. Additionally, non-audit services should be approved by audit board committees by submitting regular reports to them.

- Section 201: Prohibits certain non-audit services from the auditor of a public company: Forbids registered public accounting companies to perform some non-auditing services, e.g., tax-related suggestions, to the public companies they are auditing.

- Section 202: Requires preapproval for non-audit services: This section requires public accounting firms to seek approval from an audit committee for any non-auditing service, which is not prohibited by section 201.

- Section 203: Mandates audit partner rotation: This section requires public accounting firms to rotate their audit partners every five years.

- Section 204: Requires auditor reports to audit committees: This section requires public auditing companies to submit real-time reports to audit committees for any critical accounting practices that do not reflect GAAP standards.

- Section 205: Lists conforming amendments: Performs technical corrections and amendments in other provisions of the Securities Exchange Act of 1934 to conform to the modifications made by SOX.

- Section 206: Prohibits conflicts of interest: This section forbids conflicts of interest between auditors and public companies by restricting any member or employee of those auditing firms from being employed by those public companies.

- Section 207: Directs GAO to study the mandatory rotation of public accounting firms: Under this section, the Government Accountability Officer (GAO) must research and review the need for partner rotation in public accounting firms to prevent conflict of interest.

- Section 208: Establishes Commission authority: The Securities and Exchange Commission has been granted extra authority to create and enforce rules and regulations for the independence of external auditors.

- Section 209: Provides for appropriate state regulatory authorities: State regulatory authorities have been granted extended authority to work with federal authorities to maintain auditors’ independence.

Title III: Corporate Responsibility

Title III of SOX Compliance contains significant provisions that focus on increasing corporate responsibility by holding top executives and directors accountable for financial reporting, establishing strong auditing committees, and penalizing any irregularities in those reports.

- Section 301: Establishes public company audit committees: This section requires the creation of audit committees for public companies and sets the standards for overseeing their financial reports and audits.

- Section 302: Holds officers and directors responsible for financial reports: Requires CEOs and CFOs to personally take responsibility by certifying the financial reports, their transparency and accuracy, and any deficiencies in internal control systems.

- Section 303: Prohibits the improper influence on the conduct of audits: This section forbids top executives from influencing the auditing process by any means, such as manipulating and misleading auditors.

- Section 304: Forfeiture of bonuses and profits following restatements: This section requires CEOs and CFOs to return any incentives or bonuses received in the past 12 months based on incorrect financial reports that led to restatement later.

- Section 305: Enhances officer and director bars and penalties: This section imposes increased penalties for the officers or directors who are barred from serving in those roles if they are found to be engaging in misconduct.

- Section 306: Prohibits insider trades during pension fund blackout periods: This section prohibits executives and directors from trading company stock during the pension fund blackout periods if they obtained the stock with any connection to their employment service.

- Section 307: Establishes rules of professional responsibility for attorneys: Under this section, the SEC is required to impose strict rules on attorneys for taking professional responsibility by reporting violations to the chief legal counsel or CEO.

- Section 308: Establishes fair funds for investors: The SEC must use the penalties imposed on fraudulent corporations to compensate the affected investors.

Title IV: Enhanced Financial Disclosures

The strong provisions of Title IV of the Sarbanes Oxley Act focus more on improving the accountability and transparency of financial reports by disclosing material adjustments, prohibiting loans to executives, assessing the effectiveness of internal controls, and attestation by external auditors.

- Section 401: Provides requirements for disclosures in periodic reports: This section requires public companies to disclose any material adjustments with the SEC, such as off-balance sheet transactions and pro forma financial information, which should reflect the GAAP guidelines.

- Section 402: Enhances conflict of interest provisions: Requires the prohibition of personal loans to executives and directors of the companies except for some loans with the ordinary course of business.

- Section 403: Mandates disclosures for transactions of management and principal stockholders: Public companies must disclose any stock sale and purchase by executives and principal stockholders, such as ownership of more than 10% of the company’s stocks.

- Section 404: Requires management to assess internal controls: This section requires management to file reports with the SEC on internal control systems and the assessment of the effectiveness of the internal controls attested by external auditors.

- Section 405: Exemption for investment companies: This section mentions the exemption of investment companies from the regulations defined in sections 401, 402, and 404, registered under section 8 of the Securities Exchange Act of 140.

- Section 406: Disclose if a code of ethics has been adopted: The SEC requires public companies to disclose the adoption of a code of ethics for their executive offices, especially the chief financial officer and chief accounting officer, under this section.

- Section 407: Disclose if there is a financial expert on the audit committee: This section requires the SEC to impose regulations requiring the inclusion of at least one financial expert on its audit committee.

- Section 408: Enhances the reviews of periodic disclosures by issuers: SEC must perform a systematic, regular review of the periodic disclosures filed by public companies, including financial statements.

- Section 409: Requires real-time issuer disclosures: This section requires public companies to file real-time reports on the company’s financial position and operations.

Title V: Analyst Conflicts of Interest

- Section 501: Requires securities associations to create rules to limit conflicts of interests of securities analysts: Title V provisions of SOX Compliance require the SEC to impose rules and regulations to reduce conflict of interest by regulating securities analysts, dealers, and brokers. For example, the SEC could publish analysis reports created by people involved in investment banking, which could influence investors’ confidence. The goal is to provide unbiased and accurate recommendations to the public.

Title VI: Commission Resources and Authority

Title VI provides more authority and necessary resources for professionals to perform their responsibilities, including funding for imposing increased penalties and stopping them from practicing.

- Section 601: Authorizes appropriations to the SEC: This provision enhances the SEC’s authority to hire more staff, security controls, and technology to oversee processes, prevent fraud, evaluate risk management, and regulate financial markets.

- Section 602: Grants the Commission authority over professionals: This section grants authority to oversee professionals, such as financial advisors, auditors, or accountants, who are involved in public companies’ financial reporting processes to ensure that they do not lack integrity or character or engage in unethical or improper misconduct.

- Section 603: Authorizes federal courts to impose penny stock bars: The Securities Exchange Act of 1933 and 1934 were amended to authorize the federal courts to prohibit individuals from practicing penny stock transactions.

- Section 604: Establishes qualifications of associated persons of brokers and dealers: This section amends the Securities Exchange Act of 1934 to authorize the SEC to restrict brokers and dealers from engaging in banking, insurance, or securities business.

Title VII: Studies and Reports

Title VII requires several studies and reports by the Government Accountability Officer (GAO) and SEC to investigate and monitor several aspects of the securities industry for the identification of areas for potential improvements, such as consolidation of public accounting firms, securities laws relating to violations, or credit rating of agencies.

- Section 701: GAO study of public accounting firm consolidation: Under this provision, GAO must conduct studies on the factors leading to consolidation, mergers, and acquisitions in accounting industries, which could affect public confidence or the quality of audits.

- Section 702: SEC study on credit rating agencies: Under this provision, the SEC must report to Congress on the role of credit rating agencies, such as conflicts of interest, inaccurate recommendations, and invalid securities evaluations.

- Section 703: Study on violators and violations of securities laws: Section 703 requires the SEC to report on violations of federal securities laws by professionals like brokers and accountants and the penalties imposed to enhance regulatory oversight and accountability.

- Section 704: Study of enforcement actions: This section requires the SEC and other regulatory bodies to produce reports to Congress on the enforcement actions taken regarding violations that led to false financial statements and restatements and identify areas of improvement for inappropriate earnings management, manipulations, and fraud.

- Section 705: Study of investment banks: Under this section, GAO must report to Congress on whether individual advisors and investment banks have assisted public companies with manipulation of earnings or obstruction of their true financial conditions, as happened in the collapse of Enron and Global Crossing.

Title VIII: Corporate and Criminal Fraud Accountability

Title VIII provisions focus on increased accountability for corporate fraud by establishing enhanced penalties. Key sections include criminal penalties for tempering documents, making debts non-dis-chargeable in securities frauds leading to bankruptcy, and the major provision 806 to protect whistleblowers from corporate retaliation.

- Section 801: Short Title of Act: This title defines the short title of the provision related to the Corporate and Criminal Fraud Accountability Act of 2002.

- Section 802: Outlines criminal penalties for altering documents: This section defines the penalties for document tempering, which includes altering, destroying, manipulating, or falsifying documents. The document retention policy is 7 years, and penalties of up to $5 million and imprisonment for not more than 20 years are also included.

- Section 803: Debts non-dischargeable if incurred through securities fraud: Debts suffered via securities fraud are not dischargeable in bankruptcy proceedings.

- Section 804: Statute of limitations for security fraud: Under this section, federal judicial codes were extended for limitation laws: two years for the discovery of violation and fraud and five years after the violations.

- Section 805: Review of Federal Sentencing Guidelines for Obstruction of Justice: Review of the Federal Sentencing Guidelines for the obstruction of justice adjustments may be needed to ensure the appropriate penalties.

- Section 806: Establishes protection for employees of publicly traded companies who provide evidence of fraud: It proposes regulations to protect employees who expose fraudulent activities within the company by prohibiting public companies from retaliating against them or taking actions such as harassment, demotion, or termination.

- Section 807: Establishes criminal penalties for defrauding shareholders: Criminal penalties have been established under this section for people knowingly committing fraud against shareholders of publicly traded companies.

Title IX: White-Collar Crime Penalty Enhancements

This title focuses on increased penalties for white-collar crimes and holds company executives responsible and accountable for fraud. Key provisions include penalties for mail and wire fraud, conspiracies, violation of ERISA, and fraud in financial report accuracy.

- Section 901: Short title: This section states the short title as “White-Collar Crime Penalty Enhancement Act.”

- Section 902: Addresses attempts and conspiracies for criminal fraud: It extends the penalties for attempts and conspiracies related to fraud. The individuals involved can still be prosecuted even if the fraud is unsuccessful or completed.

- Section 903: Increases criminal penalties for mail and wire fraud: Mail and wire fraud penalties are enhanced under this provision; maximum prison sentences can last 5 to 20 years.

- Section 904: Increases criminal penalties for violations of the Employee Retirement Income Security Act (ERISA) of 1974. ERISA supervises the administration of employee benefit plans.

- Section 905: Amends sentencing guidelines for certain white-collar offenses: Requires the United States Sentencing Commission to review and amend Federal Sentencing Guidelines and ensure that they reflect the nature of crimes.

- Section 906: Holds corporate officers responsible for financial reports: Federal criminal laws were amended under this section to require company senior executives to certify that financial statements and disclosures comply with SEC laws.

Title X: Corporate Tax Returns

- Section 1001: Senate recommendations to have the CEO sign tax returns: According to this section, the corporate CEO must certify the tax returns of a publicly traded company by holding him responsible for the accuracy and reliability of the tax statements.

Title XI: Corporate Fraud and Accountability

Title XI focuses on increased accountability for corporate fraud by creating new penalties and providing the SEC with additional authorities to protect informants.

- Section 1101: Short title: Defines simply the short title of the act as “Corporate Fraud Accountability Act of 2002”.

- Section 1102: Details penalties for tampering with records or otherwise impeding official proceedings: Created new criminal penalties for people involved in document tempering or interfering in an ongoing investigation or official proceedings.

- Section 1103: Establishes temporary freezing authority for the SEC: Grants extended authority to the SEC for temporarily freezing the large transactions of financial assets of the individuals or firms involved in fraudulent activities.

- Section 1104: Provides for the amendment to Federal Sentencing Guidelines: This section requests that the United States Sentencing Commission review the United States sentencing guidelines for fraud in the securities and accounting sectors and create new penalties reflecting the nature of the fraud.

- Section 1105: Provides authority to the commission to prohibit persons from serving as officers of directors: The Securities Exchange Act of 1934 and 1933 was amended to give more authority to the SEC to ban individuals from serving as officers or directors in a public company after violating the rules for manipulation and fraudulent interstate transactions.

- Section 1106: Increases criminal penalties under the Securities Exchange Act of 1934: Amends the Securities Exchange Act of 1934 to increase penalties for violations.

- Section 1107: Provides protection for individuals who report fraud: Federal Criminal Law has also been amended under this section to give more protection to individuals (whistleblowers) who have reported fraud from the intended retaliation by the company against them.

How Pathlock Helps with SOX Compliance

Pathlock Cloud is a leading technology solution designed to help organizations automate compliance processes. It addresses important SOX requirements, especially in financial reporting, access management, and audit trails.

I. Implement Internal Control Over Financial Reporting (ICFR) with Pathlock

This is the core of SOX compliance. Auditors assess the effectiveness of controls designed to ensure the accuracy and reliability of your financial reporting. Key areas within ICFR include:

- Risk Assessment: How the company identifies and analyzes risks to financial reporting, and how it manages those risks. Pathlock AAG helps identify and assess access-related risks, while CCM allows for ongoing monitoring and analysis of those risks.

- Control Activities: The specific actions taken to address risks, such as approvals, authorizations, verifications, reconciliations, reviews of operating performance, and segregation of duties. AAG automates key control activities such as user provisioning, movement and deprovisioning of users. It provides elevated access management, user access reviews, certifications and role management which improves efficiency and accuracy. CCM consolidates controls, continuously monitors the effectiveness of these controls and provides risk quantification in financial terms.

- Information and Communication: How the company communicates financial reporting responsibilities and information, both internally and externally. Pathlock provides reporting information that supports audit responses for some compliance requirements like the U.S. Securities and Exchange Commission cybersecurity rule of July, 2023 requiring rapid disclosure of material breach information.

- Monitoring Activities: Ongoing evaluations of the effectiveness of internal controls, including periodic audits and reviews. Pathlock provides real-time monitoring of violations of business process controls and IT general controls. Monitoring changes to configurations, settings and master data and the ability to configure custom events to monitor across all transactions is a key differentiator.

II. Implement IT General Controls (ITGCs) with Pathlock

These controls support the effective operation of the ICFR by ensuring the reliability of IT systems. Key areas within ITGCs often include:

- Access Controls: Restricting access to systems and data to authorized personnel only. This includes logical access (passwords, multi-factor authentication) Pathlock provides access restrictions based upon access risk analysis and compliant provision supported by role management.

- Change Management: Ensuring that changes to IT systems are authorized, tested, and implemented in a controlled manner to prevent unintended consequences. Pathlock monitors changes to IT configuration settings and master data, including the original value, the adjusted value, and values that have been deleted.

- IT Security: Implementing measures to protect IT systems and data from unauthorized access, use, disclosure, disruption, modification, or destruction. This includes things like firewalls, intrusion detection systems, and security awareness training. Pathlock provides Cybersecurity Application Controls that include vulnerability management, threat detection and response, and transport control to protect IT systems and data. Some areas of IT Security, like firewalls and security awareness training, are covered by other solutions.

III. Implement Entity-Level Controls (ELCs) with Pathlock

These are controls that operate across the entire organization and have a pervasive impact on the control environment. Examples include:

- Fraud Prevention Program: Implementing measures to deter, detect, and prevent fraud. Pathlock provides Continuous Controls Monitoring to monitor Separation of Duties violations that a user actually did do supported by risk quantification and mitigation steps to prevent fraud.

IV. Implement Disclosure Controls and Procedures with Pathlock

These controls ensure that the company meets its obligations to disclose material information to investors in a timely and accurate manner. This includes:

- Completeness and Accuracy of Financial Reporting: Ensuring that all material information is included in financial reports and that it is free from material misstatements. Financial reporting includes reporting financial transactions that occur outside of the governance, risk, and compliance area.

- Timeliness of Reporting: Meeting deadlines for filing financial reports with the SEC. Pathlock provides real-time reporting that supports SEC reporting that relates to compliance with disclosure material breaches within the SEC cybersecurity rules.

- Internal Reporting: Providing management with the information it needs to make informed decisions about financial reporting. Pathlock provides information about violations of separation of duties and monitored transactions to support accurate reporting.

V. Conduct SOX Audits with Pathlock

SOX audits may also cover areas such as:

- Remediation of Deficiencies: Developing and implementing plans to correct any control deficiencies identified during the audit. Pathlock allows you to identify control deficiencies and correct them in advance of an audit. Accountability provides management with tools to confirm the accuracy and confidence of financial reports.

- Fraud Risk Assessment: Identifying and assessing the risk of fraud within the organization. Pathlock provides Continuous Controls Monitoring to monitor Separation of Duties violations that a user did, supported by risk quantification and mitigation steps to prevent fraud.

Read More: 19 Best SOX Compliance Software Solutions

Frequently Asked Questions About Sarbanes-Oxley

Why was the Sarbanes-Oxley Act created?

The Sarbanes Oxley Act (SOX) was passed by Congress in response to major corporate scandals in financial markets, primarily Enron, where the investigations have found weaknesses in corporate governance, accounting practices, and financial reporting, which led to billions of dollars in loss to investors. SOX has implemented strict rules and regulations on future public companies to promote transparency in financial reporting practices, protect investors, and restore their confidence in the securities industry. SOX has created the PCAOB to monitor public accounting firms by recognizing their role in those financial scandals.

Who is responsible for SOX compliance?

Senior management is responsible for the accuracy of financial reports and the effectiveness of internal controls over financial reporting. CEOs and CFOs are directly accountable for certifying those financial reports, which are additionally attested by external audit companies.

What are the criminal penalties for SOX noncompliance?

Whoever certifies a false financial statement leading to fraud will be punished with fines ranging from $1 million to $5 million and imprisonment between 10 and 20 years, depending on the seriousness of the crime and violation.

How expensive is SOX compliance?

Meeting with SOX Compliance depends on a company’s complexity and size. Larger companies, like corporations, spend more on compliance costs, but it is difficult for small or mid-sized companies to spend more on SOX Compliance than their revenue.

Who must comply with SOX?

All publicly traded companies in the United States that are registered to submit financial reports with the SEC must comply with SOX. Wholly owned subsidiaries of public companies are also required to comply with SOX. Foreign public accounting firms that conduct audits of public companies are also subject to SOX Compliance, and all accounting firms that audit public companies and are registered with PCAOB need to comply with SOX.

Is audit committee formation required by SOX?

Yes, SOX requires an audit committee formation by public companies independent of their management. This audit committee is responsible for the appointment and oversight of audit firms. It requires at least one financial expert on the audit committee. Apart from appointments and oversight of auditing firms, the audit committee also monitors the assessment of the effectiveness of internal controls and accurate reporting.